1. Introduction: The Quiet Transformation

By the end of 2025, the U.S. labor market appeared exhausted. Hiring had slowed, pay increases cooled, and traditional economic engines hit a definitive pause. However, as we enter 2026, this “cooled” economy has not led to a freeze but to a profound migration of value. While the broader market stabilizes, specific high-octane growth sectors are emerging to carry the weight of the national economy.

We are witnessing the end of the frantic “founder-led hustle” and the birth of a more calculated, selective era of productivity. According to the 2026 outlook from iShares/BlackRock, this environment—defined by above-trend growth and accelerating productivity—favors “selective risk-taking.” To thrive in this new reality, professionals and investors must identify the “signal” within the noise: the surprising niches where wealth is actually being architected.

2. The 11% Carrying the 72%: Healthcare’s Growth Monopoly

The most lopsided statistic in the 2026 labor market is the disproportionate role of healthcare. While healthcare roles constitute only 11% of U.S. jobs, they are responsible for a staggering 72% of overall job growth.

This is not a cyclical trend but a structural monopoly. As Laura Ullrich of the Indeed Hiring Lab explains, the demand is fueled by “an aging population, long-term health conditions, and the simple fact that people aren’t getting healthier.” Specifically, Cardiac Medical Technologists have become indispensable because heart disease remains the leading cause of death in the U.S.

Because these drivers are independent of economic swings, these roles are virtually recession-proof:

- Cardiac Medical Technologists: $133k median salary with a rare “double surge” (34% growth in both wages and postings).

- Nurse Practitioners: $143k median salary, with 10% of roles now offering remote or hybrid flexibility.

3. The Death of the Unicorn: Why Micro-SaaS is the New Gold Mine

The era of the “unicorn”—the billion-dollar startup fueled by venture capital—is facing a reckoning. In 2026, the data shows that while high-valuation SaaS companies frequently implode, a different breed is thriving: Micro-SaaS. These solo-built or tiny-team operations, earning 15k–50k in monthly recurring revenue (MRR), possess a survival rate that “almost never dies.”

The strategic advantage of Micro-SaaS is the elimination of “delegation distance.” By solving one focus problem with one simple solution, these businesses bypass the overhead of traditional VC models.

“One focus problem, one simple solution. No venture capital, no 50-person team.”

The “signal” for wealth here is solving “obvious problems everyone else ignores.” For example, an automated SOC 2 evidence collector can reduce compliance time from 12 weeks to just three, allowing startups to close enterprise deals faster. Other high-potential 2026 niches include AI compliance calendars for regulated industries (protecting against five-figure fines) and smart inventory predictors for e-commerce that can free up $100k in trapped cash flow.

4. The 56% Salary Premium: AI as the Great Career Sorter

In 2026, AI literacy has transitioned from a competitive advantage to a baseline survival requirement. Professionals with AI skills are seeing salary uplifts of up to 56%. In the UK, AI engineer salaries are projected to exceed £80k this year, reflecting a global “Great Career Sort.”

The value has shifted from building models to systems thinking. We treat AI as an “Iron Man suit that enhances, not replaces, human strengths.” The most valuable architects in 2026 don’t just “use” AI; they understand how it changes the wider workflow and where it fails when data quality drops.

High-Demand “Non-Technical” Technical Skills:

- Prompt Engineering: Treated as a form of repeatable system design rather than clever wording.

- MLOps (Machine Learning Operations): Focusing on the deployment, monitoring, and “drift” prevention of models in live environments.

- AI Ethics and Safety: A critical business need focused on mitigating “hallucinations” and bias propagation—active engineering problems that can cripple a brand.

5. The Fractional Revolution: Leading Without the Full-Time Overhead

Growth-stage companies are moving away from the “founder-led hustle” toward a “flexible C-suite.” This allows firms to access high-level expertise without the cost of a full-time salary and benefits—a strategic move in a year demanding budget-conscious agility.

The 5 Most Popular Fractional Roles for 2026:

- Fractional CFO: Trigger: Your books are 2+ months behind with tax season or a funding round approaching.

- Fractional COO: Trigger: You are spending 50% of your time putting out fires instead of leading a team of 10–50.

- Fractional CTO: Trigger: You are planning a major software migration, and your current systems don’t “talk” to each other.

- Fractional CEO: Trigger: The founder needs to step away for 3–12 months, or the business is in a high-stakes transition.

- Fractional CMO: Trigger: Your marketing budget is 100k–1M, but the results are inconsistent and ad hoc.

6. The Personalization Paradox: Why 51% of Your Customers are Frustrated

There is a massive “92/48” split in the market: 92% of retailers believe they are delivering effective personalization, but only 48% of consumers agree. This gap is fatal; 81% of consumers now ignore generic marketing messages.

The paradox is generational: while the average consumer is frustrated, 81% of Gen Z and 57% of Millennials actually prefer personalized ads—they just demand they be accurate. The solution is the “First-Party Data” pivot. By moving away from third-party cookies toward “zero-party data” (consented information shared directly by the user), brands are seeing massive lifts.

A “taste profile” quiz, for example, can drive a 25% conversion lift by aligning recommendations with a user’s self-reported preferences. In 2026, consent and transparency have become the ultimate growth levers.

7. The Newsletter Renaissance: 50-Year-Old Tech is “Cool” Again

In a world of unreliable social media algorithms and AI-generated search summaries, the 50-year-old technology of email has made a dominant comeback. As Inc. Magazine notes, “Emails are in right now. The more than 50-year-old communication tool has gotten cool again.”

Publishers are fleeing the “unreliable traffic” of Facebook and Google for the personal, trustworthy environment of the inbox. The scale of this renaissance is shocking: the New York Times’ The Morning newsletter now reaches 17 million readers—an audience twice the size of New York City’s entire population (8.3M). Newsletters feel like “texting a friend,” allowing creators to act as trusted advisors and bypass the noise of the modern web.

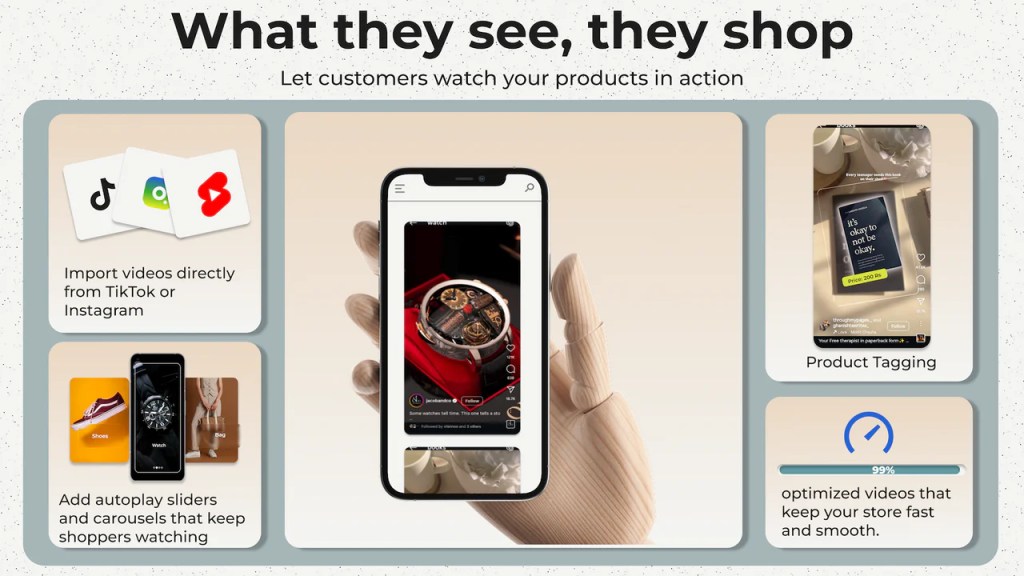

While six-figure jobs dominate headlines, the quiet truth of 2026 is this: salary alone is no longer security. Layoffs, AI disruption, and shrinking corporate loyalty are forcing smart earners to build income outside traditional work. That’s why dropshipping has become a survival strategy, not a side hustle. With no inventory, no warehouse, and minimal upfront cost, dropshipping lets you test products, scale what works, and earn globally — even while holding a job. Platforms like Spocket make this shift accessible by connecting you to vetted US and EU suppliers with fast shipping, so you can launch quickly without guesswork. If you’re serious about protecting your income and staying relevant in the new work economy, this is where to start 👉 https://get.spocket.co/l4wqhlgswnvj

8. Conclusion: The Selective Risk-Taker’s Advantage

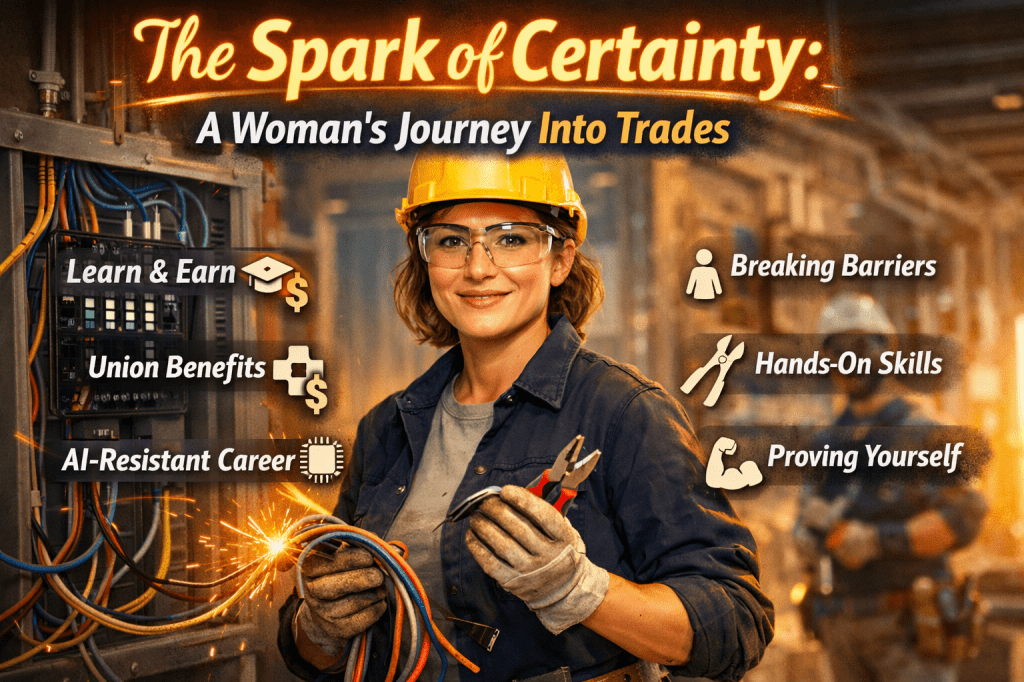

The 2026 economy favors those who can distinguish between “hustle” and “leverage.” As productivity accelerates and the labor market shifts toward specialized, AI-enhanced, and fractional roles, the migration of value is complete.

The question for your career or business is no longer about how hard you can work, but how you are architected. Are you building an “Iron Man suit” by leveraging AI and fractional expertise to solve expensive, niche problems? Or are you still relying on a “founder-led hustle” that has finally hit its wall? Your answer will define your wealth for the next decade.

Leave a comment