For generations, the “myth of job security” anchored the professional class. We were taught that a steady climb up the corporate ladder was the only rational hedge against uncertainty. But by 2026, that ladder hasn’t just been outgrown; it has largely collapsed. The modern high earner is no longer content being a mere “vehicle of firm knowledge.” Instead, we are witnessing a profound reclaiming of the individual’s cognitive property—a shift from trading hours for a salary to turning specialized ideas into direct market value.

The tension today isn’t about finding a better job; it’s about the strategic restructuring of one’s professional life. This is a manifesto for the new elite: those ready to stop being assets on a corporate balance sheet and start owning the full value of the problems they solve.

——————————————————————————–

1. The End of the “Non-Compete” Era (And the Ethics of Consent)

A fundamental barrier to professional autonomy was dismantled when the FTC’s Noncompete Clause Rule effectively neutralized the legal shackles binding most workers. As of September 4, 2024, existing non-compete agreements became unenforceable for the vast majority of the workforce. This shift marks a transition from a culture of coercion to one of consent.

The legal distinction remains sharp: “Executives vs. Sandwich-Makers.” Senior executives—defined as those earning over $151,164 in policy-making roles—can still be held to existing agreements. This isn’t arbitrary; it rests on the concept of absorptive capacity. Unlike a line-level worker, an executive possesses the specialized cognitive framework to ingest, assimilate, and weaponize firm-specific secrets.

For the rest of the professional world, the era of “mobility limitation” is over. We are no longer indentured to a firm’s proprietary walls; we are free to trade our labor where it is most valued.

“An employee gives his employer ‘but a temporary power over him, and no greater, than what is contained in the contract between ’em.’” — John Locke

——————————————————————————–

2. The 65% “Independence Premium”

The most compelling argument for independence is what I call the tax arbitrage of the self. The financial disparity between a high-salaried employee and a similarly skilled independent professional has reached a staggering tipping point.

Consider the data: An employee with a $250,000 total compensation package (including benefits) often nets significantly less than a self-employed professional generating $400,000 in annual revenue. In fact, the independent professional’s take-home pay can be 65% higher.

This “Independence Premium” is driven by three strategic levers:

- Asset Leverage: In consulting or tech, profit margins often exceed 95% because the primary “factory” is your own mind.

- The QBID Advantage: The Qualified Business Income Deduction allows for a 20% deduction of qualified business income for pass-through entities—a benefit that often requires no “concrete expense proof,” unlike the rigid deduction rules for employees.

- Expense Efficiency: Every work-related cost is deductible for the owner, whereas the employee’s work-related spending is usually an after-tax personal expense.

In 2026, the tax code doesn’t just recognize business owners; it actively subsidizes them, making self-employment the ultimate wealth-building tool.

——————————————————————————–

3. High-Ticket Leverage vs. High-Volume Hustle

The digital economy has matured past the “volume trap.” While the previous decade focused on selling thousands of $10 ebooks, the new elite focus on high-ticket leverage.

Take the affiliate model for luxury travel. A program like Villiers Jets offers a 30% commission on private jet charters. On a 35,000 charter flight, a single sale nets **10,500**. For many professionals, one such referral generates more profit than a month of traditional labor. To capture this, your focus must shift to high-value problem areas where the “willingness to pay” is baked into the niche: tech (SaaS/hosting), finance, and education.

However, the pursuit of high-ticket rewards requires a discerning eye. Watch for these Additional Warning Signs:

- Overhyped Promises: Avoid any program that relies on “guaranteed results” or inflated income claims rather than product utility.

- Lack of Transparency: Clarity in tracking, reporting, and payout structures is the hallmark of a legitimate partnership.

- Subpar Brand Reputation: Your professional brand is your only true currency; promoting a low-quality product is a form of brand suicide.

——————————————————————————–

4. The “Owner’s Draw” as a Strategic Weapon

For the LLC or S-Corp owner, the “owner’s draw” is the secret to liquidity. Unlike a rigid W-2 salary, a draw allows you to pull funds from business profits as needed, providing a layer of flexibility that salaries cannot match.

For those electing S-Corp status, the strategy is a delicate balance. The IRS requires you to pay yourself a “reasonable salary” based on your role. However, the profit that exceeds this salary can be taken as an owner’s draw. Because draws are not subject to payroll (FICA) taxes, this maneuver significantly increases net cash flow.

The danger, however, lies in the loss of discipline. The IRS is increasingly vigilant regarding “disguised distributions”—excessive draws that lack the documentation of a salary or dividend. Furthermore, “intermingling” personal and business finances is the quickest way to “pierce the corporate veil.” Once you treat your business account as a personal piggy bank without proper recording, your limited liability status evaporates, leaving your personal assets vulnerable to business litigation.

——————————————————————————–

5. The Rise of the “Micro-Asset”

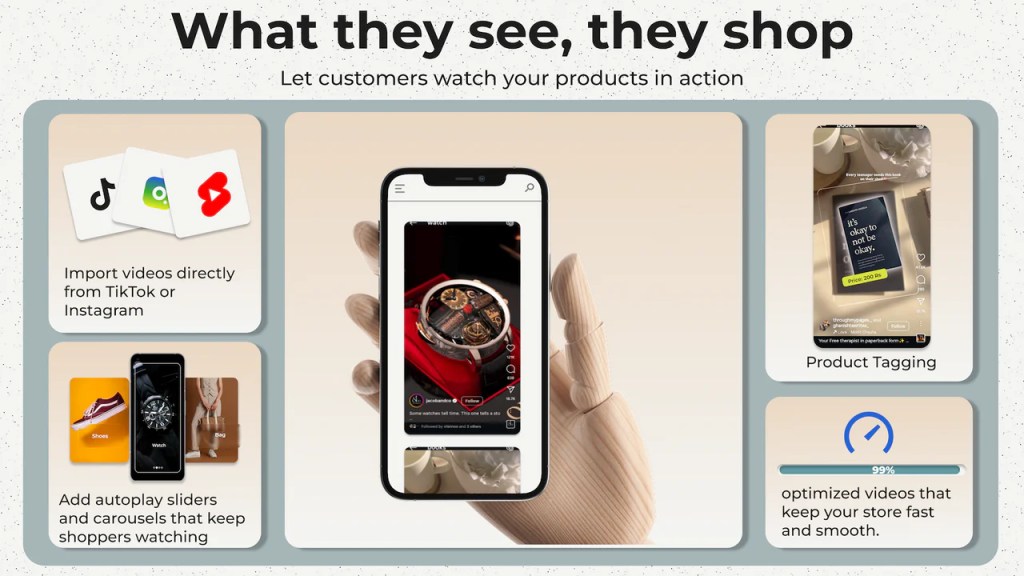

The 2026 economy prizes scalability through automation. We have entered the era of the “Micro-Asset”—Notion templates, prompt libraries, and brand kits that function as digital real estate. Using platforms like Gumroad and Shopify and connecting them via Zapier, a professional can create a system that handles thousands of global transactions without a single minute of manual effort.

These are not “side hustles”; they are automated systems that generate income while you sleep. They represent the ultimate transition from trading time for money to building a library of assets that scale with zero marginal cost.

Income Tip: Value-Based Pricing

- Ebooks & Guides: Low-friction entries (9–29) serve as lead magnets to build your audience.

- Online Courses: High-perceived-value assets (100–300). With just 20 enrollments a month, you generate 2,000–6,000 in recurring revenue without repeating the production process.

——————————————————————————–

Conclusion: The Question of True Ownership

The professional shift of 2026 is a move away from being a “vehicle” and toward being an autonomous owner of human capital. The legal barriers have vanished, the tax codes have been optimized for the independent, and the digital tools for automation are now ubiquitous.

The traditional “safety” of a salary ceiling is increasingly exposed as a risk. In a world where the infrastructure to own your value is available to anyone with the courage to claim it, the ultimate question is no longer whether you can afford to leave the corporate ladder—it’s whether you can afford to stay on it.

In a world where the legal and digital barriers to entry have vanished, are you still choosing the safety of a ceiling, or are you ready to own the full value of the problems you solve?

If you’re ready to go beyond simply earning a salary and start building ownership-based income assets, I’ve created a complete resource system designed specifically for employees who want to protect their financial future without quitting their jobs or chasing hype. The Low-Risk Ownership Income System guides you through proven, low-risk models — from digital products and templates to affiliate systems and skill licensing — with practical worksheets and planners you can start using today. Check it out here: https://payhip.com/b/8LoXW

Leave a comment